Welcome to Contempo Lincoln, a Nebraska Mobile Home Park

More than an average mobile home park, Contempo Lincoln is a friendly community of attractive and comfortable manufactured single-family homes. Conveniently located in northwest Lincoln, Nebraska, our residents enjoy safe and peaceful neighborhoods, beautiful mature trees, park-like common areas, and well-maintained housing.

Perfect for families, retirees, students, and anyone who takes pride in their home, Contempo Lincoln’s dedicated on-site team professionally manages and maintains the community on a daily basis. Pets are welcome, as are any new residents who share our commitment of keeping Contempo Lincoln a wonderful place to live!

It is tax return season! Why not use your tax return for your down payment on one of our remodeled mobile homes or a brand new home? Our down payments can be as low as ,000!

For more information or to learn about our current rentals, contact us today!

About the Contempo Lincoln MHP, LLC in Nebraska

A beautiful community of affordable manufactured home

More than an average mobile home park, Contempo MHP, LLC offers affordable manufactured housing in attractive surroundings!

Contempo MHP, LLC is dedicated to keeping our community clean, safe, attractive, and affordable. Our neighborhoods consist of manufactured homes which are built inside a factory, thus ensuring that every step of the construction process is strictly supervised. Regular upkeep and improvements of the exteriors of our residents’ homes is encouraged and enforced. Homes that don’t meet our standards will be removed. This enables us to maintain quality occupancy and housing for everyone who lives here.

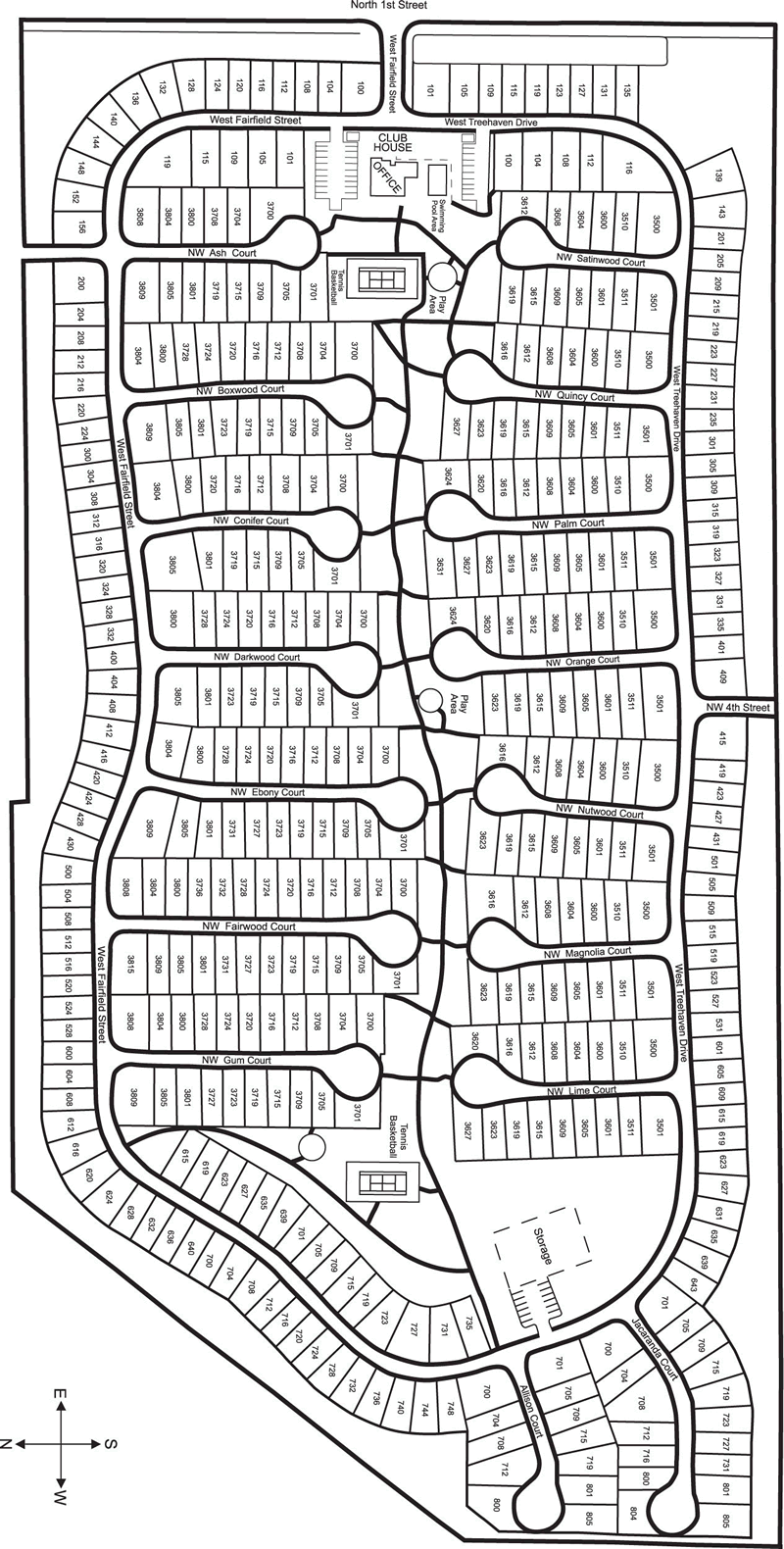

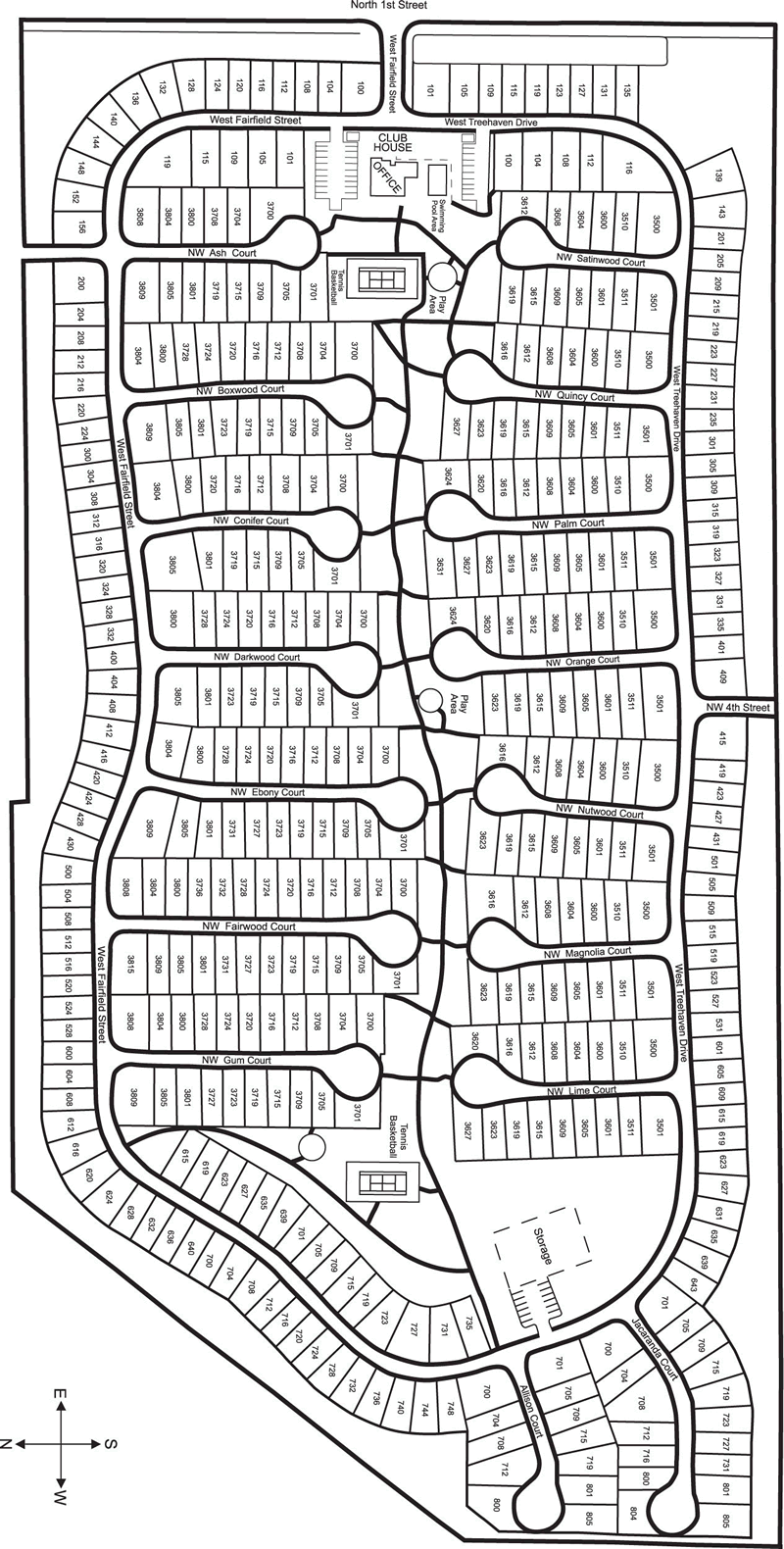

We have a total of 424 lots. Amenities for each home includes:

- Two private off-street parking places

- Paved streets

- Weekly curbside trash service (tote provided)

- Park-like common areas

- Two basketball courts

- After-hours emergency maintenance service

- Community clubhouse with conference/fellowship room, small kitchen, patios and laundry mat.

About Lots for Homeowners at Contempo MHP, LLC

We offer affordable lots to conscientious homeowners

Contempo MHP, LLC is proud to offer an attractive and safe community for all our residents. We have high standards regarding the homes that can be moved onto our lots. Regular upkeep and improvements of the exteriors of our residents’ homes is encouraged and enforced. Homes that don’t meet our standards will be removed. This enables us to maintain quality occupancy and housing for everyone who lives here.

Lots are rented on a month-to-month basis, at a rate of 5/month for a single section home, and 0/month for a double section home. Lot rental includes garbage pick-up.

If you are considering renting a lot at Contempo MHP, LLC, your manufactured home must be clean and in good shape. Please contact our management to arrange a review of your home.

Another way we ensure quality residents is by conducting credit and background checks on all applicants. An application fee of per adult.

To see which lots are currently available, please contact us today!